play plus card atm withdrawal limit

Daily withdrawal and cash limits apply. Not only can you use your account for gaming at Play locations and sites but you can use your card for purchases everywhere Discover is accepted and at any ATM that accepts PULSE and NYCE cards.

Atm Card High Resolution Stock Photography And Images Alamy

Once we approve the withdrawal in house the funds are immediately available on your Play card.

. Monthly ATM Withdrawals 2. ATM Withdrawals per Transaction 2. The daily spend limit is 10000 per day.

However VIP programs offer higher limits. However customers pay 200 for ATM withdrawals and a 295 inactivity fee if they dont use their card for 12 consecutive months. Student accounts also have lower limits to help students better manage their money.

2 The owner of the ATM may set the withdrawal transaction limit below what our limit allows. You may fund your Play card with a credit card debit card or a bank account. Point of Sale PurchasesCash Advance per Transaction 3.

4 Maximum Daily Limit of 5000 for Cash deposit. Account that may be used to fund your. Play may only be used where allowed by applicable law or regulation.

When its time to play its time to play. Play is an FDIC insured reloadable. Certain Play transactions incur small fees that differ depending on the casino or sportsbook in question and the type of the transaction.

With overseas cash withdrawals individuals who exceed withdrawal limits will have ATM withdrawals suspended for the remainder of the year and the next year. Select My Account Cashier. Why waste time searching for ATMs banks or.

However your specific daily ATM withdrawal limit will depend on the bank and the type of account. Your cash withdrawal limit varies from bank to bank. Simpler checking accounts tend to have lower limits than say a premium or elite checking account.

Choose Play Withdraw button. The card can be used at any ATM on the PULSE or NYCE network or everywhere Discover is accepted. Play load and balance limits vary by program.

And disrupt the traditional cash-based. Bank accounts will not charge any penalty for non-maintenance of the minimum balance requirement for the next 3 months. Also 3 for out-of-network withdrawals and 50 for balance inquiries plus any fee the ATM owner may charge.

Always be aware of your banks withdrawal limit especially if the money you need exceeds that amount. No more looking for ATMs or carrying cash. Select Withdraw at the top of the screen.

Favorite resort or sports account. For N26 customers the maximum withdrawal limit from an ATM is 2500 for most countries. Enter the dollar amount to transfer Any value below or up to the maximum account balance may be transferred to your Play account Click Confirm.

The maximum you can withdraw from Stash banking accounts at an ATM or Teller is 500 every 24 hours. Some banks limit daily cash withdrawals to 300. With your Play account loaded youre ready to play.

Unique Play account required for each online sportsbook. Log into your BetMGM mobile app and visit the Cashier Page. What are the ATM fees and limits.

Note you can only withdraw up to the maximum Play account balance of 25000. Maximum Daily Withdrawal Limits Vary. Most banks set their daily ATM withdrawal limit from 300 to 2500 for each business day.

Please see your Deposit Account Agreement for limits. Most ATM withdrawal limits are between 200300 a day. Play can be used for your daily spend both online and in-person and at ATMs.

The SugarHouse Play card also gives you faster access to withdrawals. International Daily ATM Withdrawals 2. The Green Dot Cash Back Visa Debit Card offers in-network ATMs with 4 free withdrawals per calendar month 300 per withdrawal thereafter.

The most significant disadvantage of Play is customers need a separate account for each online sportsbook. Since the Play card is not a credit card there is no waiting for credit approval no credit check and no credit limits to worry about. If you often need larger sums of cash it pays to ask about daily ATM limits when choosing your bank.

These updates are as follows. The CashCard enables you to get instant access to your Paddy Power winnings. Make a withdrawal to your CashCard onsite and get your winnings instantly ready to grab cash from an ATM or buy that pair of pants youve been eyeing up for weeks.

Also some limits apply to the size of your deposits. International Monthly ATM Withdrawals 2. 3 Maximum 3 transactions per day at any location providing quasi-cash services.

Just load your Play account with a bank card or checking account. We create new consumer experiences. If you need to exceed your banks limit there are ways around it.

Daily ATM withdrawal limits range from a few hundred to a thousand dollars. The standard maximum amount of funds you can load to your account is 2000 per day 4500 per week and 10000 per month. Daily ATM Withdrawals 2.

In the past there was no limit except for RMB100000 set per year per account. Log in to see your Account Agreement for ATM withdrawal limits. The ATM withdrawal limit at some banks can be as high as 5000 while others will only let you withdraw 300 per day.

Debit card holders can now withdraw cash from ATMs of any bank anywhere in the country without incurring any additional transaction charges for the next 3 months. You can also lower the withdrawal limit in your smartphone app. Limits are set by each bank.

Daily Point of Sale. Play is the smarter way to access your money before you start to play. 2022 Get Play Plus.

If you are successful in submitting your withdrawal request you will receive an e-mail confirming it has been received. Heres a look at some major banks ATM withdrawal limits. The standard limits are 2000 per day 4500 per week and 10000 per month.

However in the event you win a Jackpot most Play programs will allow your casino operator to load up to your cards maximum balance limit. Customers will have to pay Rs 21 per transaction at their own banks ATMs to withdraw money once the limit exceeds after the change is. According to Asia Gaming Brief Union Gaming stated that they do not expect the changes to have an impact on GGR.

For example a premium checking account will have a higher limit than a student account. Keep in mind that these limits apply to checking accounts. You can withdraw money with no.

Bank of America on the other hand allows for up to 800 in daily cash withdrawals and most Citibank accounts allow for up to 1000.

Credit Debit Or Atm Card What S The Difference The Milford Bank

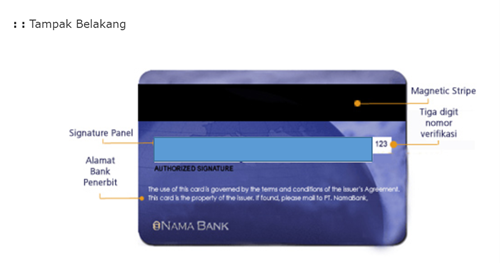

Wah Debit Bca Kini Bisa Digunakan Untuk Transaksi Online Finansial Bisnis Com

Cara Mengambil Uang Di Atm Tanpa Kartu Pada Berbagai Bank

Man S Hand Inserting A Credit Card In Atm Hand Inserting Atm Plastic Card Into Bank Machine To Withdraw Money Finance Money Editorial Photo Image Of Code Closeup 171954011

How To Use A Prepaid Credit Card At An Atm 9 Steps